The market capitalization of a cryptocurrency is a key indicator that measures the total value of all its circulating units, calculated by multiplying the price by the number of units in circulation. It plays a crucial role in determining the perceived risk associated with a cryptocurrency.

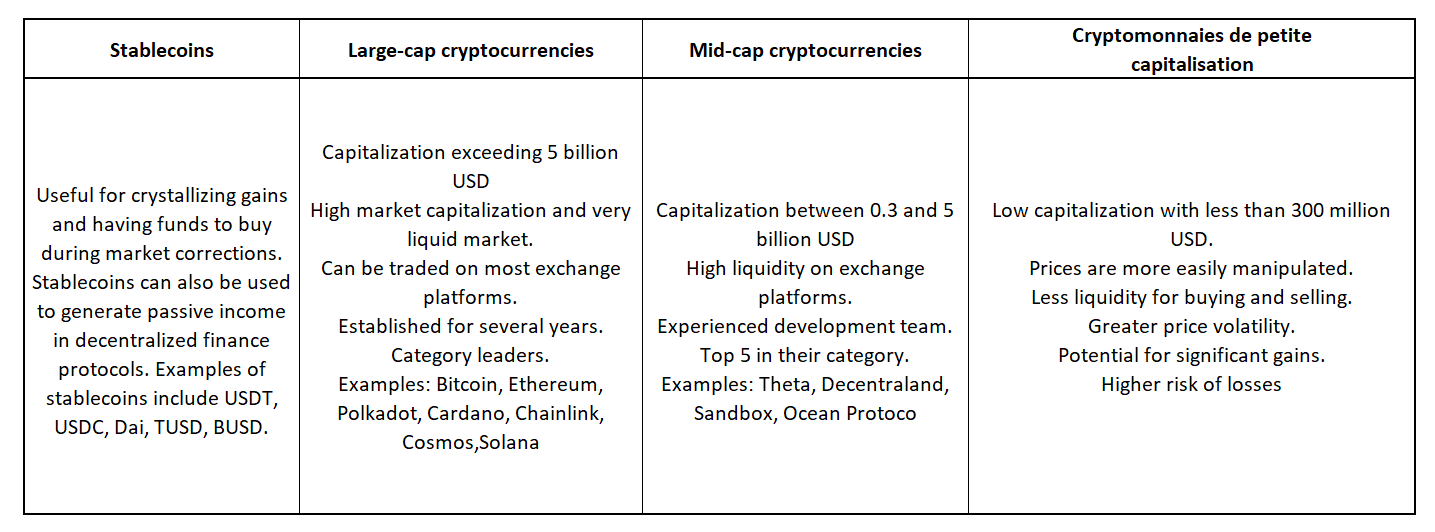

1. Stablecoins: Stablecoins, such as USDT, USDC, Dai, TUSD, BUSD, are cryptocurrencies designed to maintain a stable value, typically pegged to fiat reserves. They are useful for crystallizing gains, accumulating funds during market corrections, and generating passive income in decentralized finance protocols.

2. High-Cap Cryptocurrencies (over 5 billion USD): Well-established cryptocurrencies like Bitcoin, Ethereum, Polkadot, Cardano, Chainlink, Cosmos, Solana. They have a high market capitalization, are traded on most exchange platforms, and have been established for several years. While leading in their category, their risk is generally considered lower due to stability and high liquidity.

3. Mid-Cap Cryptocurrencies (between 0.3 and 5 billion USD): Cryptocurrencies like Theta, Decentraland, Sandbox, Ocean Protocol, which have a more modest capitalization but offer high liquidity on exchange platforms. With experienced development teams, they often rank among the top in their category, presenting a moderate risk compared to low-cap cryptocurrencies.

4. Low-Cap Cryptocurrencies (less than 300 million USD): Cryptocurrencies with a capitalization below 300 million USD, as mentioned in the example. They have a price that is easier to manipulate, reduced liquidity for transactions, high price volatility, high profit potential, but a higher risk of losses. These cryptocurrencies are often considered more speculative and require a more cautious approach due to their volatile nature.

In summary, market capitalization is a crucial indicator to assess the level of risk in the cryptocurrency world. Investors should carefully consider market capitalization, liquidity, volatility, and other factors to make informed decisions based on their risk tolerance and investment goals.

Bitcoin Case Study (High-Cap Cryptocurrencies): Illustrating the concepts discussed, let’s explore the case of Bitcoin:

- New market entrants often choose Bitcoin first.

- News events significantly impact Bitcoin’s price, as the market is influenced by emotions.

- Major institutions use derivatives markets to create sharp corrections.

Conclusion: As we navigate the complex landscape of cryptocurrency investments, understanding how market capitalization influences risk is crucial. The provided insights equip investors with the knowledge needed to make informed decisions, adapt to market dynamics, and thrive in the evolving crypto space.