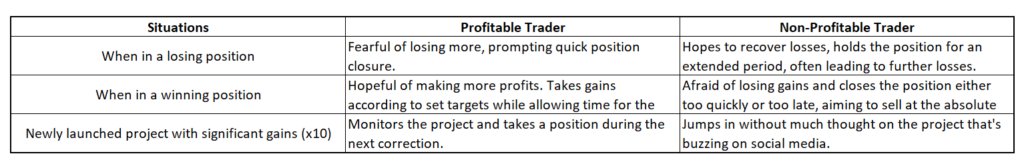

Adopted behavior and mindset to become a profitable trader over time

“In this comparative analysis between a profitable long-term investor and a non-profitable long-term investor across various scenarios, distinct patterns in behavior and mindset emerge.

-

Correction in the Market:

- Profitable Investor: Exhibits unwavering convictions, holding positions with confidence during temporary market corrections.

- Non-profitable Investor: Reacts emotionally to market fluctuations, making impulsive buy or sell decisions under the influence of short-term market sentiment.

-

Parabolic Market Surge:

- Profitable Investor: Systematically takes profits based on a well-established investment plan.

- Non-profitable Investor: Lacks a clear investment strategy, often holding onto positions without taking profits, even in the face of substantial gains.

-

High Market Volatility:

- Profitable Investor: Regularly monitors asset performance, maintaining a less emotionally charged response to market volatility for a more pleasant investing experience.

- Non-profitable Investor: Obsessively tracks daily price movements despite having a long-term investment strategy, subjecting themselves to unnecessary stress.

-

Project Fundamental Challenge:

- Profitable Investor: Skillfully cuts losses when needed, ensuring a disciplined approach to risk management.

- Non-profitable Investor: Holds onto losing positions for extended periods, hoping for a recovery and often incurring substantial losses.

In summary, the profitable long-term investor demonstrates disciplined decision-making, a commitment to risk management, and a strategic approach to both profits and losses. On the other hand, the non-profitable long-term investor tends to be emotionally reactive, lacks a clear strategy, and often makes decisions driven by short-term market sentiment, leading to unfavorable outcomes over time.