Selecting the Right Centralized Cryptocurrency Exchange: Key Considerations

When it comes to choosing a centralized exchange for cryptocurrency transactions, several crucial factors should guide your decision-making process for a secure and streamlined trading experience.

-

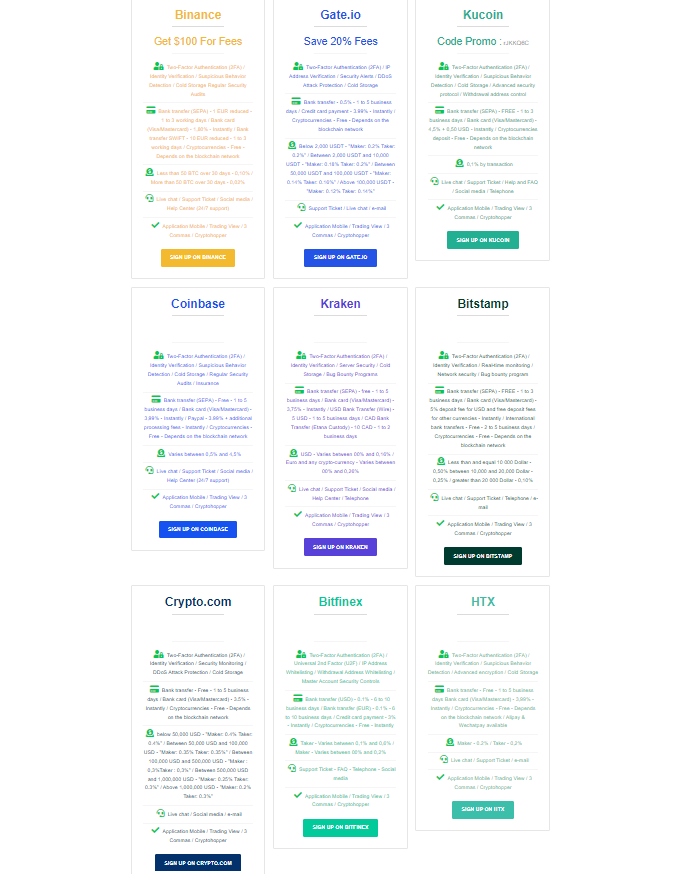

Security: Give priority to platforms with robust security features, including two-factor authentication (2FA) and secure cold storage for user funds. Opt for exchanges with a proven track record in safeguarding user assets against cyber threats.

-

Deposit Methods, Fees, and Processing Time: Evaluate the available deposit methods, considering associated fees and processing times. Different exchanges offer various payment options, and understanding the costs and timeframes involved will empower you to make well-informed decisions.

-

Trading Fees: Scrutinize the fee structure of each platform, including maker and taker fees. Some exchanges may provide fee discounts based on trading volume or membership levels. A thorough comparison of fee structures will help you choose a platform that aligns with your trading frequency and budget.

-

Customer Support: A responsive and helpful customer support team is indispensable for addressing issues promptly. Seek out platforms offering multiple communication channels, such as live chat, email, or phone support. Reading user reviews can offer insights into the quality of customer service provided by each exchange.

By diligently considering these factors, you can confidently select a centralized exchange platform that caters to your specific needs, ensuring a secure and efficient environment for cryptocurrency purchase and trading.

You can click here to access our comparison of various centralized exchange platforms.

I invite you to download the attached Excel file to the course, where you will find a comprehensive comparison between different centralized exchange platforms.