Determine your investor type!

- Scalping: Holds positions for a few minutes/hours.

- Day trading: Closes positions each day.

- Swing trading: Holds positions for several weeks.

- Investor: Holds positions for the long term.

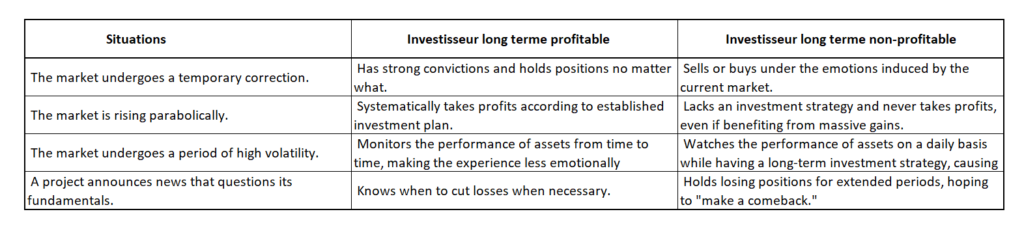

Adopted behavior and mindset of a profitable long-term investor and a non-profitable long-term investor

The table compares two long-term investor profiles, one being profitable and the other non-profitable, in various market situations. Let’s observe how these two types of investors react to different market scenarios:

-

The market undergoes a temporary correction:

- Profitable long-term investor: Demonstrates resilience by holding positions with strong convictions.

- Non-profitable long-term investor: Reacts to market emotions, impulsively buying or selling.

-

The market rises parabolically:

- Profitable long-term investor: Systematically takes profits according to the established investment strategy.

- Non-profitable long-term investor: Lacks a clear strategy, never takes profits even when experiencing massive gains.

-

The market undergoes a period of high volatility:

- Profitable long-term investor: Manages volatility by periodically monitoring asset performance, avoiding excessive emotional influences.

- Non-profitable long-term investor: Unnecessarily stresses by daily tracking asset prices despite having a long-term investment strategy.

-

A project announces news that questions its fundamentals:

- Profitable long-term investor: Knows when to cut losses when necessary, making decisions based on rational analysis.

- Non-profitable long-term investor: Holds losing positions for extended periods, hoping to recover losses.

This table highlights the importance of having a clear investment strategy and resisting emotional influences for long-term success in financial markets. It also emphasizes the need for careful risk management and discipline for long-term investors.