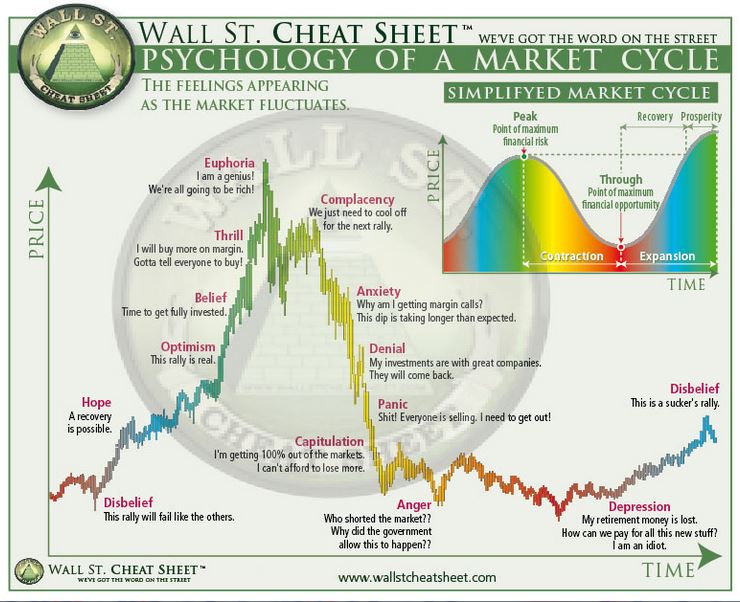

Decoding Market Cycles: Unveiling the Emotional Landscape with the Wall Street Cheat Sheet

The financial markets are characterized by cycles, phases of euphoric highs to depressing lows. Understanding these cycles is crucial for investors, as they often result directly from the emotional reactions of market participants. The ‘Wall Street Cheat Sheet: Psychology of a Market Cycle’ provides a unique visual perspective on how investors’ emotions evolve throughout the various stages of a market cycle. Let’s explore this psychological roadmap that can serve as a guide to navigate the ups and downs of financial markets and make informed decisions.

The “Wall Street Cheat Sheet: Psychology of a Market Cycle” is a visual chart illustrating the different emotional phases experienced by investors during a financial market cycle. This graphical representation is designed to assist investors in understanding and navigating the cyclical fluctuations of financial markets based on predictable human behaviors.

Here is an explanation of the key phases of the market cycle according to the “Wall Street Cheat Sheet”:

Accumulation:

Informed investors begin accumulating assets at low prices. Market confidence is low, and most people remain pessimistic.

Bull Market:

Prices start rising, attracting public attention. Optimism and enthusiasm increase, prompting more people to invest.

Euphoria:

The market reaches its peak, prices hit highs. Optimism is extreme, and many novice investors enter the market.

Distribution:

Informed investors start selling their assets, realizing profits. Signs of an impending correction become apparent, but most investors remain optimistic.

Bear Market:

Prices begin to decline, creating a sense of fear among investors. Optimism turns into concern, then despair.

Desperation:

Panic sets in, and many investors sell at a loss. Pessimistic outlook dominates, and some abandon the market.

Capitulation:

Selling reaches its peak, marking the market bottom. Investors are emotionally and financially exhausted.

Hope:

Prices start to recover slightly. Remaining investors hope for a market turnaround.

This representation aims to highlight the predictable emotional reactions of investors throughout the market cycle. It underscores that financial markets are influenced by psychological factors as much as fundamental data and encourages investors to remain aware of their emotions to make informed decisions.